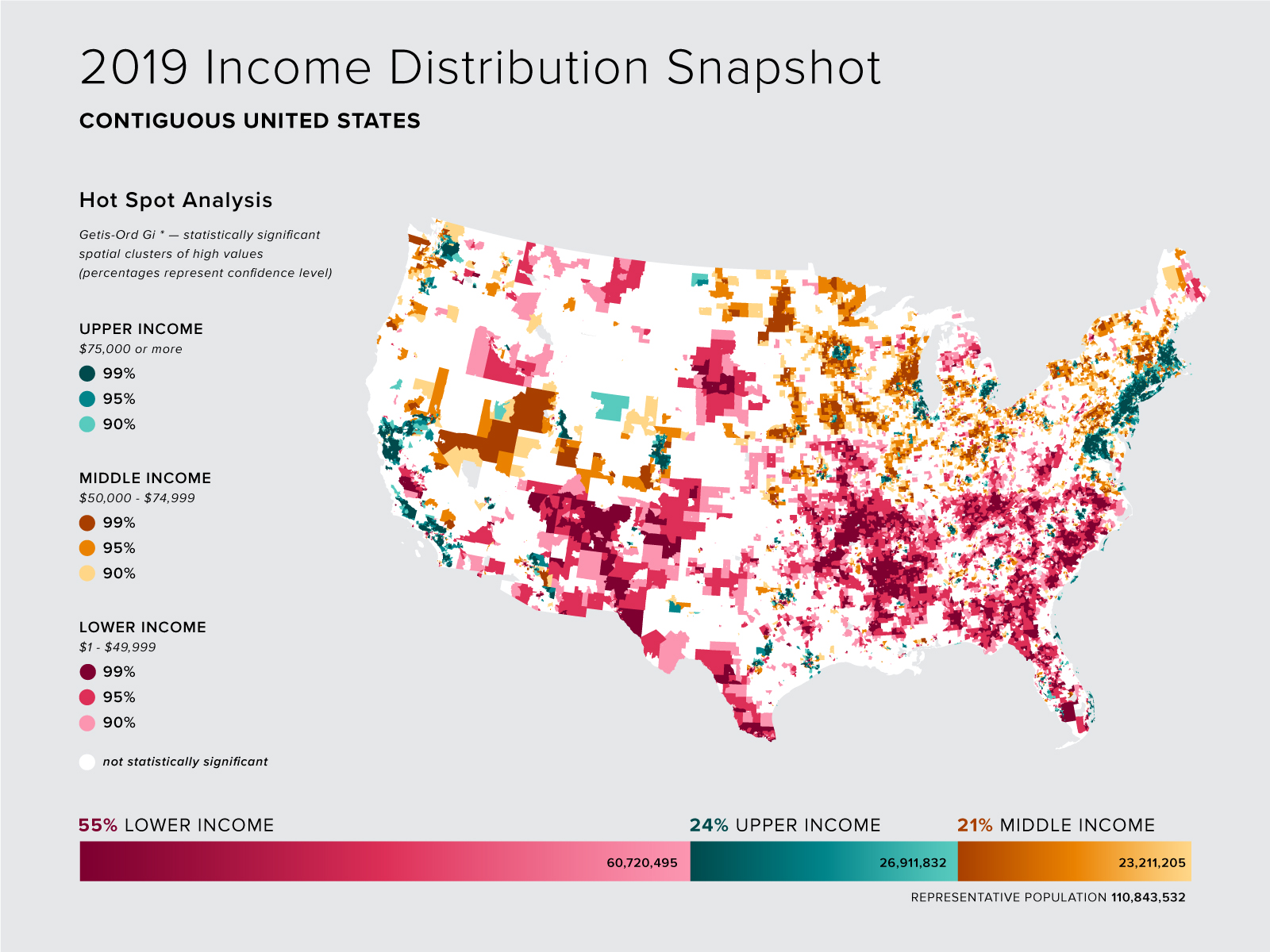

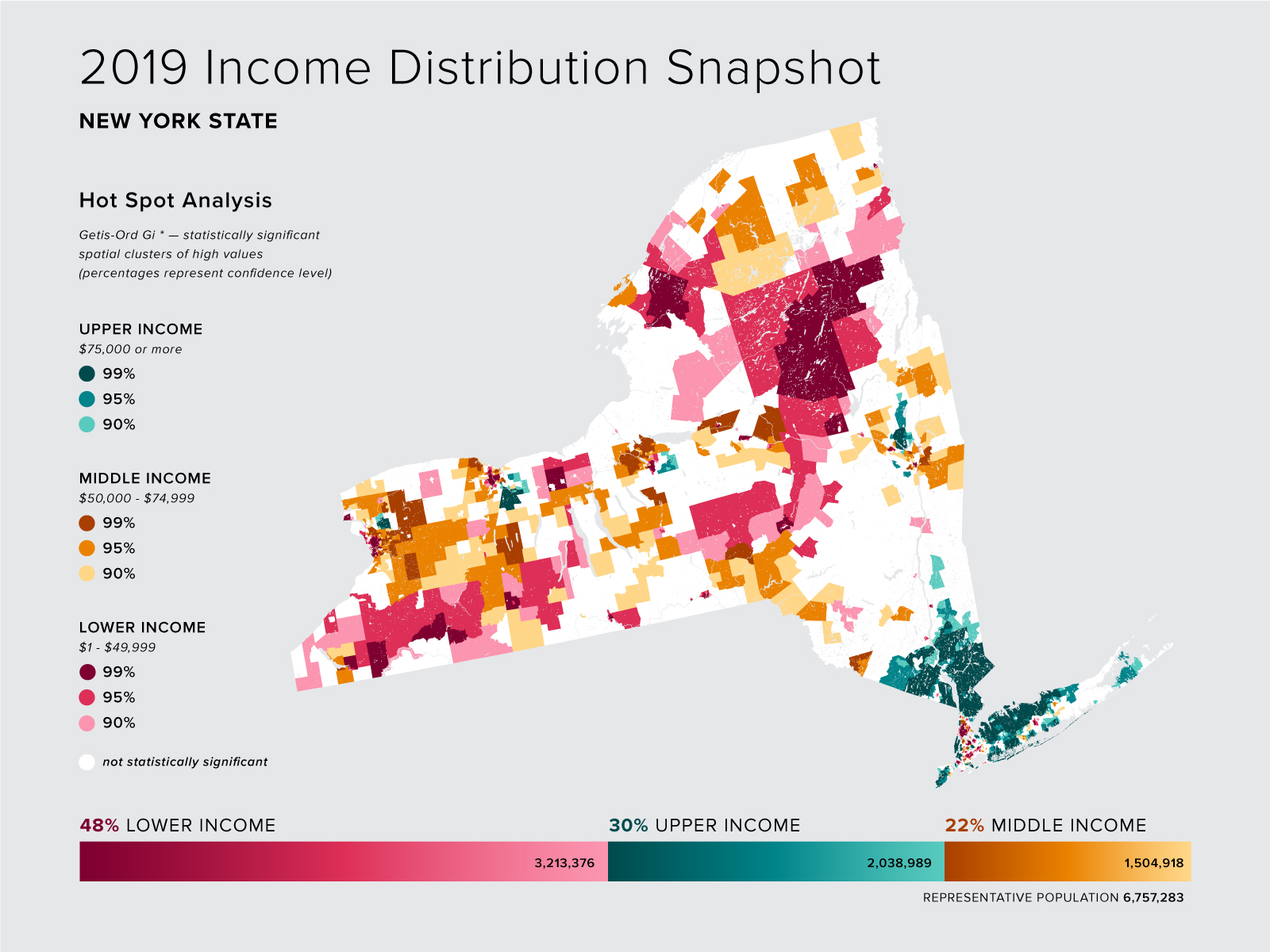

METHODOLOGY (AND SOME MORE DATA) Aiming

for more accessible and mappable data, my first task was to simplify the eight income brackets into

three more manageable categories: lower, middle and upper. Not wanting to arbitrarily determine what

constitutes lower, middle and upper incomes, I referenced the U.S. Bureau of Labor Statistics' 2019

Consumer Expenditure Survey (CE). The CE is a nationwide survey, representing over 98% of the

population, that captures data on demographics, earnings, and expenditures. Although complex and

detailed, the data is limited in that it looks at individuals and does not take into account when

multiple earners contribute to household expenses. Yet, even with this limitation, I found the data

to be a helpful guide. 2019 survey respondents were broken down into income quintiles - each

representing one fifth of the total population. Incomes and average expenditures were provided for

each quintile — painting a stark picture of which income groups were and were not able to live

within their means.

After an initial review of the data, I determined that lower incomes (anything less that

$50,000) constituted those unable to meet their expenses, while middle incomes ($50,000 - $74,999)

could meet their expenses and, potentially, get slightly ahead, and upper incomes ($75,000 and

higher) could comfortably pay all expenses while also generously saving.